Business Coaching From Business Professionals

Practical coaching that delivers results – $295 for a 1-hour session.

The Small Business Australia coaching service puts your business on the fast track to achieving real results and reaching your business goals sooner.

Personal Effectiveness

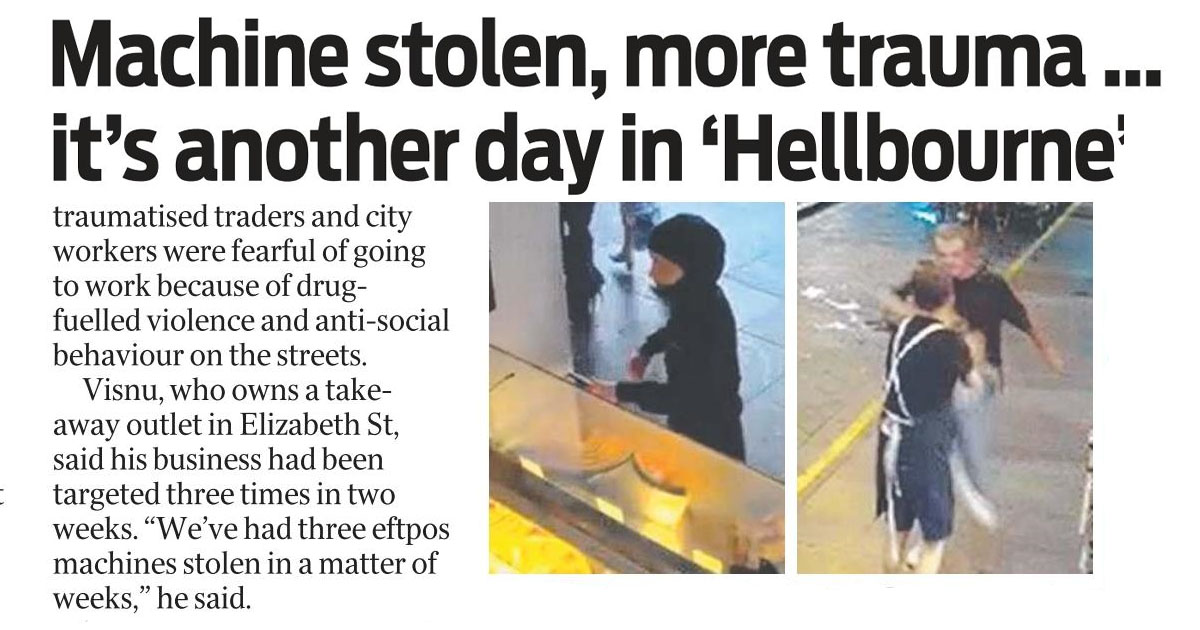

The challenges of running a business have never been more demanding. From the impacts of the pandemic, changing customer needs and demands, the competition from around the world and the avalanche of information and interruptions, many business owners are feeling a loss of energy, focus and optimism.

Improving Cashflow and Finances

Cashflow is the lifeblood of any small business. Offering exceptional goods or service is no use if you can’t pay staff, rent or your other obligations.

Regardless of your industry or situation, there are financial fundamentals that will help you plan and manage your income and expenses to help you not just survive, but thrive.

Attracting New Customers

In today’s global marketplace, small businesses face competition like never before. You’re no longer just competing with local or even interstate businesses – often, you’ll be battling against global brands with limitless resources.

But with challenge comes opportunity: if you can tap into just a fraction of your total available market, you can truly take your business to the next level.

Keeping Existing Customers

Your Keeping Existing Customers coaching session will provide practical and proven strategies, actions and tools across the sales, fulfilment and relationship management functions of your business. You can implement these insights straight away to keep current customers coming back and to increase purchase frequency and/or average sale size.

Improving Online Strategy

Regardless of your product, service, industry or size, your business needs to have an online presence in the digital age. If potential customers can’t find, speak to or order from you in their preferred method, they’ll find someone who they can.

The good news? While it can feel overwhelming for busy business owners to develop an online presence, once you have a plan, some tools and a little education, it’s much easier (and cost-effective) than you think.

Recruiting and Training Employees

Since the onset of the pandemic, the availability and demands of employees in many industries have never been more complex. Australia is currently experiencing low unemployment rates and changes to what benefits employees are looking for, making it harder for some businesses to attract employees more than customers.

Small Business News and Events

Keep up to date with the latest in small business

Memberships

Join Small Business Australia today for free and stay up to date with the latest in small business news.

View our range of premium BusinessAdvantage® memberships. Whether you are looking to find more time to work on your business rather than in it, more income and profit for your efforts or less stress and worry over the risks and challenges of running your business, BusinessAdvantage® will help.