New Fair Work Changes: Closing Loopholes Act No.2

Explore the transformative Fair Work Amendment, Closing Loopholes No. 2, reshaping Australia’s labor dynamics. Vital for businesses to grasp for compliance and adapt seamlessly.

Australia's employment landscape is undergoing a monumental shift with the Fair Work Legislation Amendment (Closing Loopholes No. 2) now officially passed and set to bring a slew of significant changes for both employers and employees. Understanding these changes is paramount for businesses aiming to navigate this new legal terrain confidently and compliantly. In this article, we delve into the crux of the Closing Loopholes No. 2 amendment, breaking down the notable changes and offering guidance on how businesses can gear up for compliance.

Background: The Closing Loopholes Saga

In December 2023, the Australian government passed the first act of the Closing Loopholes amendment to the Fair Work Act, targeting wage theft and redundancy among other issues. However, recognising the need for further clarity and reform, the Senate divided the original bill, leading to the separate passage of Closing Loopholes No. 2. This separation allowed a more focused debate on pressing matters within the employment sector and has culminated in the enactment of a comprehensive set of reforms designed to tighten regulations and protections within the workforce.

Key Changes Under Closing Loopholes No. 2

Final Thoughts

The enactment of the Closing Loopholes No. 2 amendment signifies a substantial evolution in Australia's employment laws, impacting aspects like work-life balance, the gig economy, and fair employment practices. It's imperative for businesses to reassess, recalibrate, and renew their workplace policies and practices proactively. By doing so, they can avoid penalties and cultivate a healthier, more robust work environment.

Closing Loopholes No. 2 emerges as a milestone towards a balanced, equitable, and respectful workplace culture where the delineation between professional and personal life is increasingly important.

Original article published on the Sprintlaw website on February 24 2024, read here. Accessed 26 April 2024.

Save up to $700 with this offer!

Sprintlaw Membership Offer for Small Business Australia

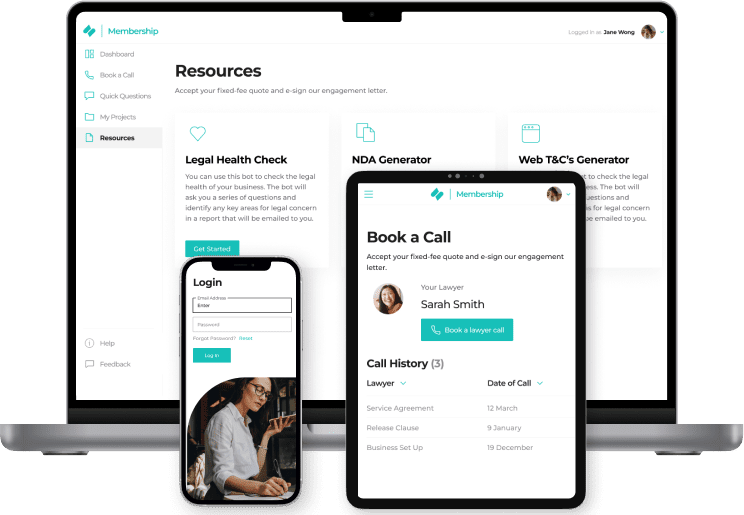

Sprintlaw are offering a 12-month business legal helpline for only $99 + GST (save $700) through their Sprintlaw Membership. Book a call with a lawyer, get discounts on fixed-fee legal services, and send documents for e-signature through Sprintlaw’s award-winning portal – all for one low fee.